The Nationwide Funds Company of India (NPCI), the governing physique behind the nation’s extensively used cell cost system Unified Funds Interface (UPI), is ready to collaborate with varied fintech startups this month to develop a technique to deal with PhonePe’s rising dominance out there. and Google Pay within the UPI ecosystem.

NPCI executives are planning to satisfy representatives of CRED, Flipkart, Fampay and Amazon, amongst different gamers, to debate their key initiatives geared toward growing the variety of UPI transactions on their respective apps and perceive what sort of assist they want, folks aware of the matter informed TechCrunch this query.

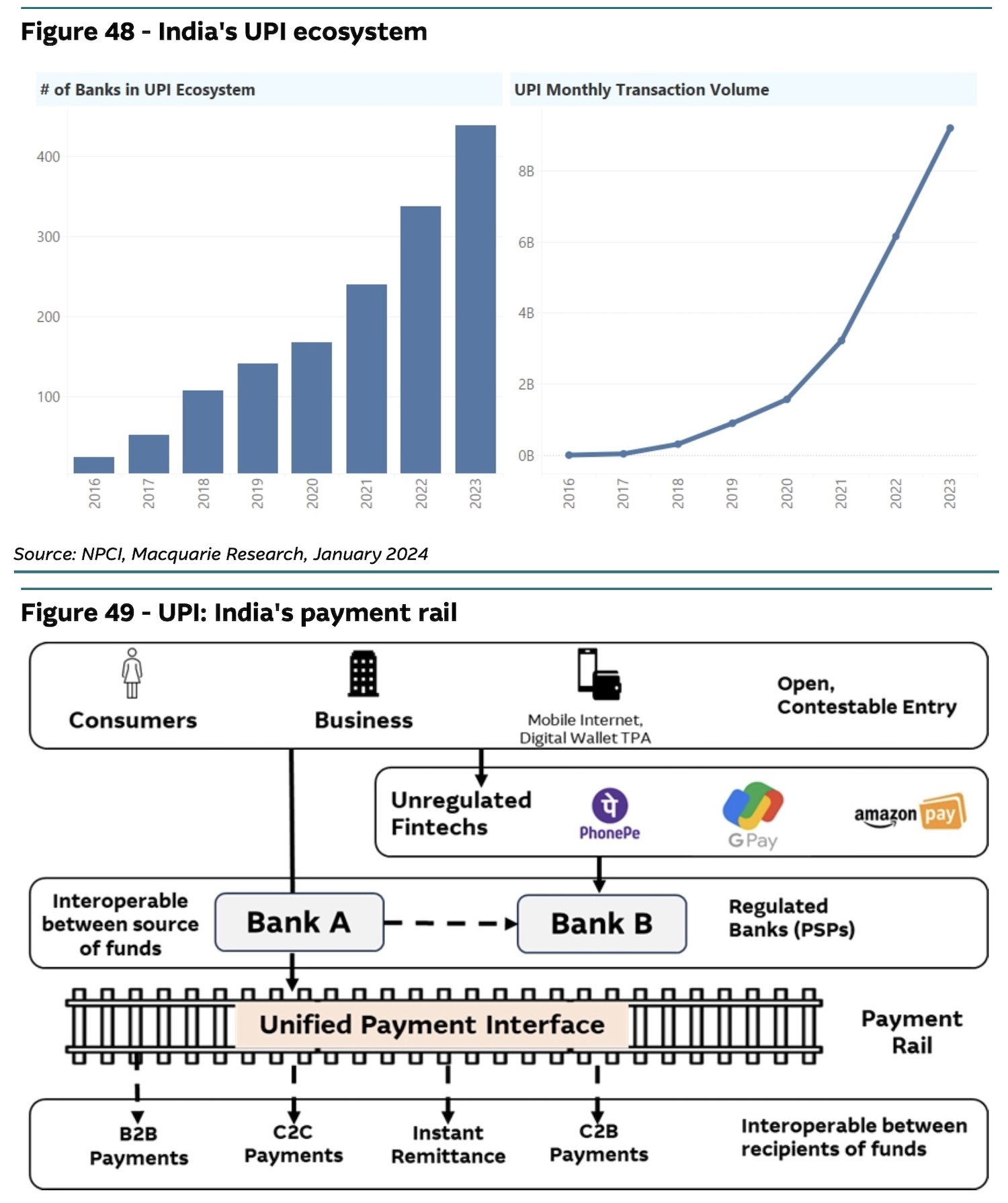

Created by a coalition of Indian banks, UPI has turn out to be the preferred mode of on-line transactions in India, processing over 10 billion transactions each month.

The brand new conferences are a part of rising efforts to deal with considerations raised by lawmakers and trade gamers over the focus of market share of Google Pay and PhonePe, which collectively account for almost 86% of UPI transactions by quantity, up from 82.5% on the finish of final 12 months. December. Walmart owns greater than three quarters of PhonePe.

Paytm, the third largest UPI participant, decreased its market share to 9.1% by the tip of March from 13% on the finish of 2023. suppression by the Reserve Financial institution of India (RBI).

An summary of the Indian UPI ecosystem. (Picture: Macquarie)

The dialog adopted the central financial institution expressing its “dissatisfaction” with NPCI over the rising duopoly within the funds trade, an individual aware of the matter stated. An NPCI spokesman declined to remark.

In February, an Indian parliamentary fee referred to as on the federal government help the expansion of home fintech gamers which can supply options to Walmart-backed PhonePe and Google Pay apps.

NPCI has lengthy advocated limiting the market share of particular person corporations taking part within the UPI ecosystem to 30%. Nonetheless, it has prolonged the deadline corporations should adjust to this directive till the tip of December 2024. The group faces a novel problem in guaranteeing compliance with this directive: it believes that There’s presently no technical mechanism for thisThis was beforehand reported by TechCrunch.

The RBI can also be contemplating an incentive plan to create a extra favorable aggressive area for brand new UPI gamers, one other particular person aware of the matter stated. Indian day by day Financial Instances individually reported On Wednesday, NPCI inspired fintech corporations to supply incentives to their customers by selling using eligible apps for making UPI transactions.